“He spent years scrimping and saving. But without a will, where’s his money going?” By Claire Martin

On the afternoon of Aug. 22, 2015, Dale Tisserand and Melani Rodrigue opened the front door to a small white house in Corning, Calif., a town of 7,500 about 115 miles north of Sacramento. The women, who’d been given the keys by local police, are investigators for the office of the Tehama County Public Administrator. They knew the owner had died in the house the previous week and that his name was Eugene Brown.

The neighborhood mail carrier was the one who’d called the police. Every day, Brown would wait for her in a chair by his door, and the two would exchange pleasantries. But for the past five days, there’d been no sign of him. Police did a welfare check and discovered his body in a pool of dried blood by the toilet. Members of the coroner’s office who were dispatched to the house determined that he died of a stroke, but not before breaking his nose in a nasty fall. They did a quick search for a will and contact information for family members and friends—return addresses on envelopes, phone numbers jotted on scraps of paper. Not finding anything, they called Tisserand and Rodrigue.

Many counties in the U.S. have public administrators, though a lot of people don’t know they exist. They operate within the murky ecosystem of public agencies and private businesses that kick into gear when someone dies: locksmiths, biohazard and trauma cleanup services, trash haulers, auctioneers, real estate agents, courts, attorneys, and banks. Tisserand and Rodrigue were in Brown’s house to locate his will and heirs, which can be difficult when people die alone. They would also oversee his estate. Even a simple death, something peaceful in your sleep, requires the assistance of an awful lot of people.

Public administrators in California usually report to the district attorney’s office, the sheriff, or some other county agency. Only a few, such as Rodrigue, head standalone departments. She has dark hair and deep-set brown eyes that serve as a barometer of her mood. “Yes! You Can!” is one of several inspirational sayings scrawled on her office’s dry-erase board, near a sign that reads “Boss Lady.” Rodrigue was appointed public administrator of Tehama County in 2012 after having a similar job in a nearby county. Tisserand, a no-nonsense former legal secretary with frosted hair and a soft spot for animals, works as one of her three deputies. They get along well. Sometimes they call each other by the nicknames El Capitan and Cash Money.

Upon receiving Brown’s case from the coroner, Rodrigue and Tisserand took their usual first step of arranging for a locksmith to meet them at the house; changing the locks lets them take control of the property and ward off squatters. They rerouted Brown’s mail to their office, since a get-well card or bank statement could provide valuable information about relatives and assets. Then they began their search.

The vast majority of houses Rodrigue and Tisserand see are in severe disrepair. They often find themselves wading through the detritus of a life that had begun decomposing years, if not decades, before they arrived. It’s not uncommon for them to find rooms packed to the ceiling with garbage or a gaggle of semiferal pets huddled under a sofa. One time they discovered the jellified remains of cats—30 of them—individually wrapped inside cardboard boxes. Another time they rescued and found homes for a pack of mange-infected dogs. The investigators’ nicknames for each other stem from a memorably fragrant visit to a mole-infested trailer park where they sifted through urine-soaked garbage to uncover rolls of cash that had been stuffed in medicine bottles. Another colleague with them that day, who busted open a locked trunk, is now known as the Hammer.

Before Tisserand and Rodrigue enter a house, they put on hazmat suits and dab their noses with Vicks VapoRub. They work in pairs, never alone—both for safety and to preserve the integrity of an investigation. Rodrigue and her investigators are a tightknit crew, connected by the arcane and often macabre nature of the work. Unwrapping the gelatinous remains of several dozen cats has a particular way of bonding people.

Sometimes the valuables they find are dangerous, such as the time they stumbled upon $15,000 worth of handguns and rifles, most of them loaded. But there are very few surprise treasures—sometimes there are even debts. If an estate is in the black at the close of an investigation, the public administrator takes a cut as payment: 4 percent of the first $100,000, 3 percent of the second $100,000, 2 percent of the next $800,000, 1 percent of the next $9 million, and 0.5 percent of the next $15 million. If an estate has more than $25 million, a court determines the fee. County attorneys are paid according to the same structure.

The investigators brought their hazmat suits to Brown’s house but could tell from the meticulously trimmed bushes and recently mowed front lawn that they wouldn’t be needed. So they slipped the key into Brown’s lock and opened the door. A quick scan from the entryway revealed a pleasantly clean, even spartan scene: The living room was empty but for a folding chair and a built-in bookshelf with religious titles and a few dozen country and western cassettes. An old black-and-white photograph of a woman, maybe Brown’s mother, sat framed on a small table. What the house lacked was more noteworthy than what was there: no stereo, no TV, no computer, no cellphone. The only electronic device, a defunct old-fashioned radio, was perched on the fireplace mantle. A 1984 Ford pickup with 74,000 miles on the odometer was in the garage.

In the kitchen, the stove had been pulled away from the wall. A mini fridge contained two Kraft cheese singles and an open can of beans. Instead of pots and pans, the cabinets held a small manual typewriter, some T-shirts, and a few pairs of underwear. Rodrigue and Tisserand also discovered a small box of index cards with addresses and phone numbers Brown must have consulted before using the rotary phone on the wall. They plucked a promising-looking card for an emergency contact. Near the door to the garage, a paper calendar was blank except for marks crossing out past days.

The blood covering the bathroom floor didn’t faze them; death can be messy, and they routinely call in cleaning crews that specialize in crime scenes. But what they encountered in the two bedrooms really threw them off. Brown didn’t have a bed, just a foam bedroll tucked into the corner of one bedroom and a military duffel containing an old uniform and medals. The next bedroom was also strange—it only had a metal filing cabinet. When they opened it, “we were just blown away,” says Tisserand, who became the lead investigator on the case. It appeared Brown had been a wealthy man.

“Every time I hear about somebody that has millions and millions but they lived a frugal life, I go, ‘Why? Have some fun’ ”

Eugene Brown’s story could be anyone’s. True, most people who can afford to buy a bed sleep in one. But 56 percent of Americans don’t have a will, according to a 2016 Gallup poll. Even the fabulously wealthy and highly accomplished sometimes neglect them. Prince and Aretha Franklin died without a will; so did Abraham Lincoln and Martin Luther King Jr. It’s also easier than you might think to fall out of touch with relatives, whether because of apathy, distance, or feuding. Social media creates a veneer of interconnectedness, but there are still tens of millions of people who can’t be so easily found. A 2018 Pew Research Center survey found that 11 percent of Americans, including 34 percent of people older than 65, don’t go online at all.

When someone dies without a will, family trees dictate where the money goes. Each state has its own method to determine the line of succession. California’s is fairly standard: Spouses come first, followed by children, parents, siblings, grandparents, aunts and uncles, and finally nieces and nephews. A few states veer from the norm; in Kentucky and Texas, the surviving spouse and children split the estate in complex percentages that can require advanced accounting to calculate.

The legal protocol raises some important philosophical questions. Why should a family member who never knew Great-Aunt Ethel be able to lay claim to her assets over a relative who’s emotionally more connected if genetically less so? What about beloved charities? Even where the law seems clear, gray areas exist. Tisserand and Rodrigue navigate the gray. “Every time we get a referral,” Tisserand says, “we walk into somebody else’s life and try to figure it out.”

In the case of Brown, here’s what they found: He was born in San Jose in 1922 to parents who’d migrated from Oklahoma in search of work. He had a brother and a sister, both of whom died decades ago. In the summer of 1939, Brown was certified as a cabin steward by the now defunct Bureau of Marine Inspection and Navigation, which enforced laws governing merchant vessels. His photo ID shows a baby-faced 16-year-old with brown eyes and hollow cheeks. In 1941, Brown was hired as a so-called mess boy, or food server, for a Norwegian shipping company that paid him a monthly wage of 79 kroner (about $18 at the time). Rodrigue and Tisserand know this because he detailed his salary and expenses in an accounting book. In January 1942, midway through World War II, he left that job and took a similar one with the U.S. Merchant Marine.

Over the years, Brown’s face filled out and softened. His 5-foot-6½-inch frame remained trim, but his shock of brown hair turned silver. His remaining relatives aren’t sure what he did for work after the Merchant Marine. He moved to Corning in the 1970s. He never married or had children, and he spent his last 39 years alone, mostly inside his 810-square-foot house. He clocked fewer than 2,500 miles per year in his truck.

Brown didn’t leave a will, but he did leave some money. In his bedroom file cabinet were paper statements from Merrill Lynch and Bank of America Corp., prospectuses from the investment manager BlackRock Inc., and his own handwritten ledgers with frequent entries tracking the values of various mutual funds: the BlackRock Munivest Fund, Franklin California Intermediate-Term Tax-Free Fund, and Nuveen Limited Term Municipal Bond Fund. Brown kept tabs on these investments the only way he knew how: with a pencil and paper. Rodrigue and Tisserand checked his math, then set about figuring out who would inherit his life savings.

Tisserand tried to find Brown’s relatives using skip-tracing software called TLOxp, which sifts through scores of public and private records. Nothing came up. This wasn’t surprising given Brown’s complete lack of a digital footprint. He didn’t have credit cards, he wasn’t online, and his two major purchases—his home and his Ford truck—were made in the 1970s and ’80s. But Tisserand was able to estimate that they, along with his investments and savings account, were worth roughly $2.7 million.

A Sacramento company called Brandenburger & Davis seized on that figure, publicly available in the public administrator’s court filings, along with the lack of known heirs. Forensic genealogists working for the company, which specializes in the obscure field of probate research, also known as heir finding, worked to re-create Brown’s family tree and contact anyone who was still alive. If Brown had relatives, it would try to take them on as clients, offering to represent them in court proceedings to confirm their status as rightful heirs. In exchange, it would take a contingency fee of a third of the inheritance. But if any relatives learned of Brown’s death on their own, and wanted to represent themselves in court, Brandenburger & Davis wouldn’t get anything.

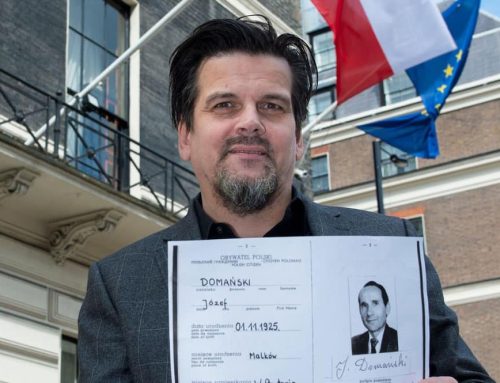

Heir finders operate in relative obscurity in the U.S. and face a fair amount of suspicion. Receiving a call or email out of the blue with news of a potential inheritance from a relative you’ve never heard of can seem sketchy. “They think it’s a scam of some kind,” says Daniel Curran, founder of the trade group International Association of Professional Probate Researchers, Genealogists & Heir Hunters, who also runs his own heir-finding business in the U.K. Curran is a regular on Heir Hunters, a BBC documentary procedural that’s popularized the industry in Europe. Unexpected inheritances are quite common, he says. “If you can’t name both your parents’ cousins, every single one of them, then there’s a chance you can be a surprise beneficiary of something.”

Probate companies are often intentionally vague when they first contact someone; they might not divulge the name of the deceased relative or the amount of money hanging in the balance. This approach is meant to prevent a runaround—an heir making a claim on the estate without paying the fee. Adding to the industry’s credibility problem is that a few U.S.-based companies ran afoul of the Department of Justice a few years ago. They were charged with colluding on pricing and sharing contingency fees. For instance, when one made contact with an heir, the others would back off, but then they’d all share the fee. Brandenburger & Davis was one of them; it pleaded guilty to federal charges in 2016 and paid $890,000 in fines. (The company declined to comment for this article.)

Although heir finding might seem less viable in the age of Ancestry.com, there’s more to the work than a few online searches. Probate research companies have access to private databases and know how to obtain the genealogical documents needed to establish heirship. In some Tehama County cases, for instance, heirs have to produce birth and death certificates for their parents, grandparents, and great-grandparents.

Once Rodrigue and Tisserand finished excavating Brown’s house, they called an estate liquidator to look for and appraise additional valuables they may have missed. There wasn’t much. Next they needed to verify that the Merrill Lynch accounts were active and the balances current. Tisserand contacted Brown’s investment adviser, Richard Mazur, who immediately asked if she was calling about him. “I’ve been so worried about him, because I talk to him every single day,” Tisserand recalls Mazur telling her. Mazur declined to be interviewed for this article, but Tisserand says he told her Brown called him every morning before the New York Stock Exchange opened and again in the afternoon after it closed. “We’ve been doing it for years and years,” he said of their daily communication. When she told him Brown had died, Mazur cried so hard he had to hang up.

The next day, Mazur called back. He said he felt like he’d lost a family member. Despite his frequent conversations with Brown, which his assistant at Merrill Lynch also participated in, he didn’t know much about Brown’s actual family, because Brown “wasn’t that type of person, and they didn’t feel like it was their place to get into his family,” Tisserand says. But they did discuss his Catholicism. Mazur was confident Brown wanted his assets to go to a Catholic charity.

The only written clues to Brown’s final wishes were tucked into the file cabinet: a brochure titled Making Your Will: A Good Steward’s Guide, published by Catholic Relief Services, an international aid group, and a Merrill Lynch form designating the nonprofit as the sole beneficiary of his investments. He’d filled out the form four days before his death—but hadn’t signed it.

This, it turns out, is the most difficult part of a public administrator’s work: discerning the final wishes of a stranger who hasn’t spelled out those wishes. Rodrigue and Tisserand are responsible for deciding whether to cremate or bury someone and what type of funeral to plan, if any. With Brown, they focused on his service uniform and medals, which he’d kept for more than 70 years. His estate could afford a funeral with military honors, including a full-gun salute by honor guards—all of which ran about $3,000—so that’s what they organized.

Only one person attended Brown’s burial: an assistant funeral director named Blanca Rico, who worked at the local funeral home. Occasionally, Rico digitally records the burials of people who die without friends or family to attend. “I always think, That’s somebody’s son, that’s somebody’s brother, that’s somebody’s dad. They were a somebody in this world,” she says. This time, though, she had another reason to be there. Rico had lived on Brown’s street for a time. They’d wave hello when they saw each other. Once, several years ago, he’d even helped her fix a faulty weed trimmer. The day of the service, held at Northern California Veterans Cemetery, Rico filmed Brown’s funeral on her smartphone. A team of inmates, who were doing cemetery maintenance as part of their work-release, paused to watch.

A couple of months after the funeral, Brown’s lawful heirs finally surfaced. They were his sister’s children: a niece and three nephews. Brandenburger & Davis had found them but would be representing only two of the four, Ken Kaufmann and his sister, Kristie Kaufmann Shapiro. The other nephews intended to represent themselves. Brandenburger & Davis had only told them of an unnamed relative’s death. Ken and his sister responded first and said his brothers learned of Brown’s identity from him. Conveniently, that meant they could avoid the heir-finding fee.

Ken isn’t happy about that. Nor, presumably, is Brandenburger & Davis. “They intended to ride on the coattails of their siblings,” says Tracy Potts, principal of the law firm Legacy Law Group, which represents the company in its probate cases. The other siblings declined to be interviewed for this article, but Tisserand says one of them told her he periodically visited his uncle. She couldn’t find any information to back up his claim—no photos, no mention of the Kaufmanns in any paperwork, a distant cousin listed as his emergency contact instead of this supposedly close nephew who visited regularly. Ken says his brother visited but he and his other two siblings hadn’t seen Brown in more than 50 years.

Kaufmann agreed to work with Brandenburger & Davis because, as one of the first heirs to respond, he didn’t have much of a choice. Only after he signed away a third of his potential inheritance—an amount he assumed would be only a few thousand dollars—did they reveal Brown’s identity. “I thought a third was a lot,” he says. “But I look at it this way: If it hadn’t been for them, we would not know that he passed away and that he had things to offer.”

Kaufmann was stunned when he learned how many “things” Brown could offer. Kaufmann didn’t come from a wealthy family. His mother, Brown’s sister, had about $5,000 to her name when she died in 1996. From Brown, though, Ken and his sister each received $387,000. Their brothers each got an additional $193,000. “None of us had a clue that there was going to be a lot of money involved,” Kaufmann says. “It was definitely a mindblower.”

At 70, Kaufmann still works as a master carpenter; he doesn’t plan to retire, but the inheritance means he can work less. He remembers how thrifty Brown had been and that he selected the no-frills, base model of any car he bought. Kaufmann, on the other hand, says he’s already spent “a big chunk” of his inheritance. Not one for base models, he bought a Cadillac and three or four motorcycles, including a 2018 Harley-Davidson. He also admits to losing money at casinos. He thinks his siblings have saved their portions, but “I didn’t want to have that money tucked away and then pass away and never enjoy it,” he says. “Every time I hear about somebody that has millions and millions but they lived a frugal life, I go, ‘Why? Have some fun.’ ”

It’s hard to imagine this is what Brown had in mind for his money during the many years he obsessively tracked the stock market and stored his earnings. And given his meticulousness, it’s mystifying that he didn’t write a different ending for himself. Did he change his mind about the Catholic Relief Services or simply forget to sign? Or was he hesitant to go against the grain by not leaving his money to his relatives?

Potts, the lawyer who represents Brandenburger & Davis, maintains that people who don’t have a will are still expressing an intention. They know their money will go to their family. “I don’t think it’s a mystery that intestacy exists,” she says, using the legal term for the genealogical succession that kicks in when a person dies without a will. “And so, I do think that it is the right place for it to go. It is ultimately what most people would choose.”

Tisserand isn’t so sure. As far as she can tell, Brown’s heart was with the Catholic Church. She also keeps thinking about another of his relatives, Delaine Evans, that distant cousin he listed as an emergency contact in his makeshift address book. She was the only family member Tisserand could tell he still talked to. Every few months, Brown composed a letter to her on his typewriter. He congratulated her on her retirement, asked after her grandchildren, regaled her with news of Northern California heat waves and his work on his yard.

Evans understood Brown. Her own mother, Brown’s first cousin, was similarly frugal and equally wealthy when she died, despite having worked as an Oklahoma schoolteacher her entire career. The Great Depression and World War II left an indelible imprint on their spending habits, she says. “I think it did something to their psyche.” Evans was surprised to learn how reclusive her cousin had become. “It made me feel like nobody really deserved to get anything from him,” she says. Her letters were the only evidence Rodrigue and Tisserand found that proved he had a family.

Day to day, Brown spent more time with the birds that flocked to the feeders he’d built and hung outside his house than he did with people. Three years after his death, the area surrounding his backyard still sounds like a veritable bird sanctuary—a legacy he presumably would’ve enjoyed, and one that might outlast his money.

Rodrigue and Tisserand may have never met Brown, but through their work they came to know him as a solitary, thoughtful man who counted his cousin and investment adviser as his only friends. And yet a different set of people, those with the highest concentration of his DNA coursing through their veins, are the ones who received his wealth. Kaufmann says he was surprised when the heir finders first told him whom they were contacting him about. He’d thought his Uncle Gene was already dead.

This article has been first published in Bloomberg.com